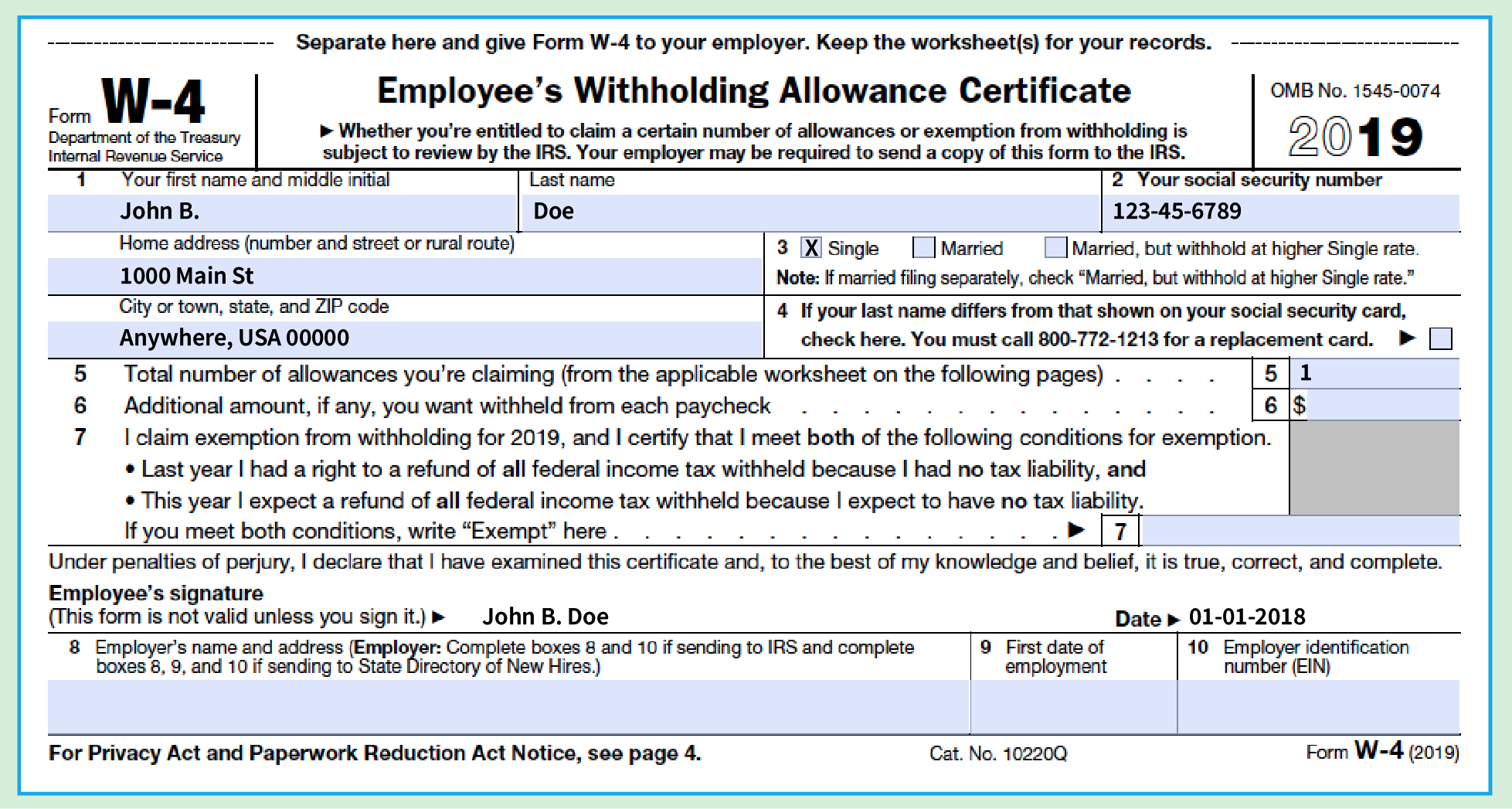

W4 2025 Exempt. If you are single, have one job, have no children, have no other income and plan on claiming the standard. This is because you are starting to work so late into the year, that you won't owe enough to owe federal taxes.

How to Fill Out an Exempt W4 Form 2025 Money Instructor YouTube, This is because you are starting to work so late into the year, that you won't owe enough to owe federal taxes. It has only five steps.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Can an employee be exempt from federal income tax? If your employee does not know if they are exempt, direct them to that.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Being exempt means your employer won’t withhold federal income tax from your pay. A virginia federal district court granted summary judgment to hirepower personnel, inc.

How To Fill Out W4 Tax Form In 2025 FAST UPDATED YouTube, Being exempt means your employer won’t withhold federal income tax from your pay. Page last reviewed or updated:

W4 Exemption In Taxes Tax rules, Tax, Tax preparation, All you need to do is fill out step 1(a), step 1(b), and step 5 of the form and write exempt in the space under step. 2025 michigan income tax withholding guide:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, In box 7, you will need to write “exempt”. If your employee does not know if they are exempt, direct them to that.

Cómo Llenar la Forma W4 ᐈ GUÍA COMPLETA【2025, Yes, someone can claim they’re exempt from federal income tax if they meet the following criteria: How to claim exempt status?

How to Fill Out an Exempt W4 Form 2025 Money Instructor, Page last reviewed or updated: If your employee does not know if they are exempt, direct them to that.

W4 Form 2025 How To Fill Out Mona, On the flsa claim of a staffing company employee, finding he was. Being exempt means your employer won’t withhold federal income tax from your pay.

What Is Form W4?, Page last reviewed or updated: If your employee does not know if they are exempt, direct them to that.

This is because you are starting to work so late into the year, that you won’t owe enough to owe federal taxes.

:max_bytes(150000):strip_icc()/W4eng-b237d0a065e642b1abdba0fa653d8c1b.jpg)